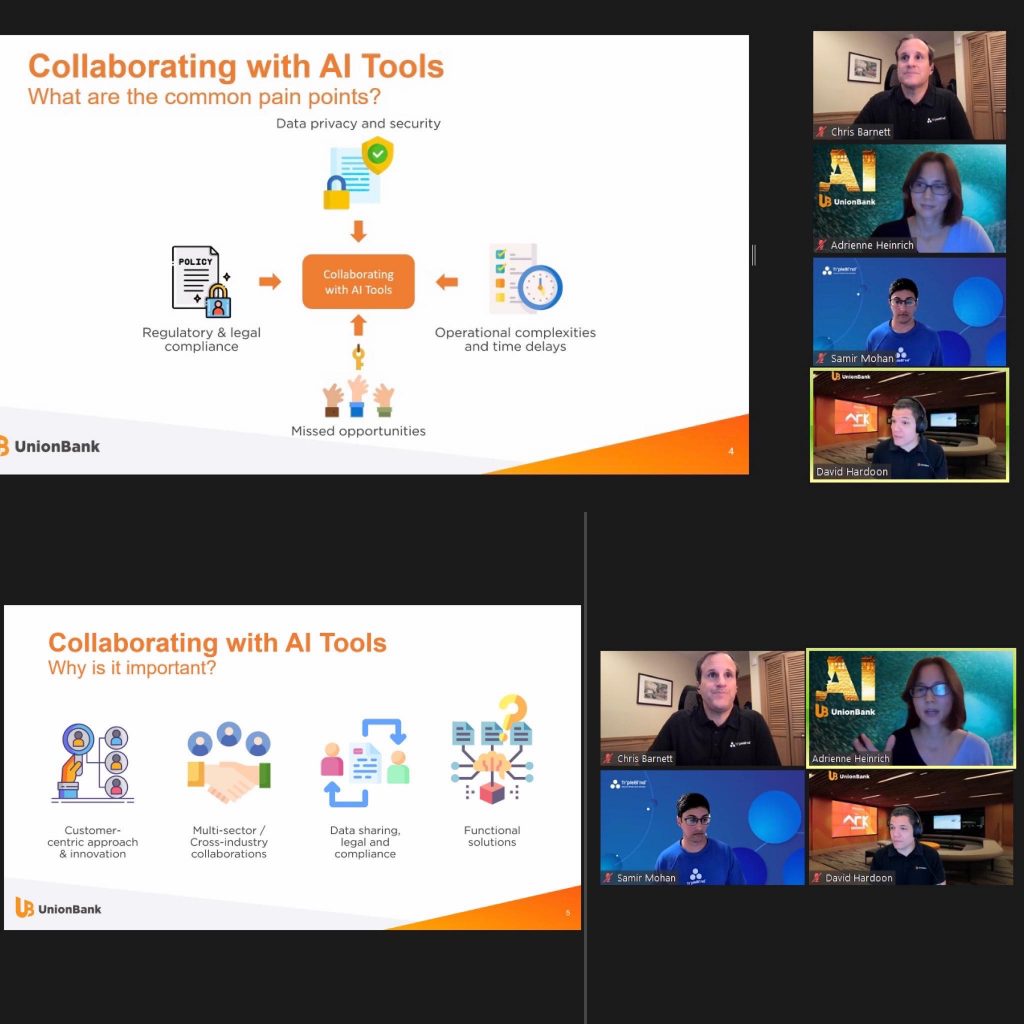

A webinar on collaborating with AI tools in financial services was recently presented by Union Bank of the Philippines (UnionBank) and TripleBlind, a US-based data and artificial intelligence (AI) services provider. Dr. David Hardoon, the Bank’s Chief Data & AI Officer, and Dr. Adrienne Heinrich, the Head of AI Center of Excellence, emphasized the significance of client centricity and collaboration when it comes to offering data and AI-driven solutions to consumers.

Customer centricity, according to Dr. Hardoon, is a critical component of banking and finance since it allows banks and other financial solutions providers to produce more tailored products and services that answer consumers’ specific demands.

“Everything that we do—when we go buy a car, when dealing with insurance or healthcare, thinking of our future house—ultimately is situated and substantiated on our finances. So, how do we go about truly personalizing and accommodating one’s need? It’s important to really have that centricity,” Dr. Hardoon stressed.

He added that true breakthroughs in terms of solutions can be achieved through collaboration with players in other sectors, as doing so will bring in a vast amount of outsider expertise into the co-creation process. “Customer centricity has to be done through collaboration, and that naturally leads to the multi-sectorial approach, providing better, more specific products, better solutions,” Dr. Hardoon said.

“For us at UnionBank, it’s very important to put the customer at the center, and therefore, we seek to develop customer-centric AI solutions. Besides looking at AI solutions for banking-specific features, we’re also looking at innovative solutions beyond banking,” mentioned Dr. Heinrich.

She likewise noted that solutions providers should consider value-adds for clients to enable them to have customer relationships in a more holistic way. This would assist clients in their areas of interest or in what they want or need to spend money for.

“We can actually see that this is really a customer need when looking at major topics that come up in personal finance forums on the web. We can see that less than 20 percent of the conversations actually mention banking products or services,” Dr. Heinrich emphasized.

UnionBank is always looking for new ways to collaborate with industry or academic partners in order to give greater value to its clients. This, according to Dr. Heinrich, will allow the Bank to move quickly with fresh ideas. She then gave an example of AI in healthcare, citing a hypothetical scenario in which a bank could have access to a big pool of data on individuals with specific chronic conditions.

According to Dr. Heinrich, “By running machine learning models on this data, we can give financial advice for the coming months and years to be able to cover the cost for the treatments and have patients select their preferred life-enhancing products or services accordingly. And we can also easily enhance the data set with our own data of the customer, and that can be shared back to the care provider, if the patient agrees.”

There really are a lot of possibilities collaborating with AI tools in financial services.

No Comments