Find out if you can afford the home of your dreams through Nook’s website.

Looking for a pre-qualified home loan in just minutes? And are you ready to fulfill your dream of buying your very own home? Chances are, you may be overwhelmed by the sheer thought of this undertaking, which is perfectly understandable given that it is a huge step. But fear not – purchasing your dream home has never been more exciting, given the wide options out there!

Here are four (4) tips to guide you as you begin your journey to owning your dream home:

1) Identify your “must-haves”

Before you start looking around, think about what you want in a house, and list these down. For instance, do you need a driveway? How many bedrooms are you looking for? Do you prefer a standalone unit or is a condominium more suitable for your purposes? Each option will have a different impact on the price of the property and therefore your monthly budget. By knowing what these are, you can be able to streamline your search easily.

2) Determine your budget

This step is very important, as buying a house is a big financial responsibility and will impact your finances for the long term, especially if you are going to take out a loan for this. Know how much equity you have available and determine how much you can afford to pay in monthly amortizations. Typically, housing payments should take up no more than 30% to 40% of your monthly income. Once you know the price range you can work with, then your selection will be more focused.

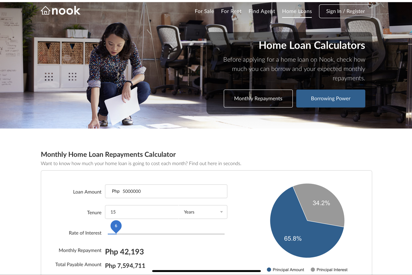

This website also provides a loan calculator that can help you estimate how much you can borrow given your budget and how much your monthly loan will be.

3) Consider location carefully

You can never underestimate the importance of location, especially in light of the dreadful traffic situation in Manila. While it is understandable that you would want to be close to your present place of work, do consider your future plans and that of your family when choosing between locations. Consider proximity to important destinations, as well as access to transportation hubs. Keep watch on upcoming government infrastructure projects as well.

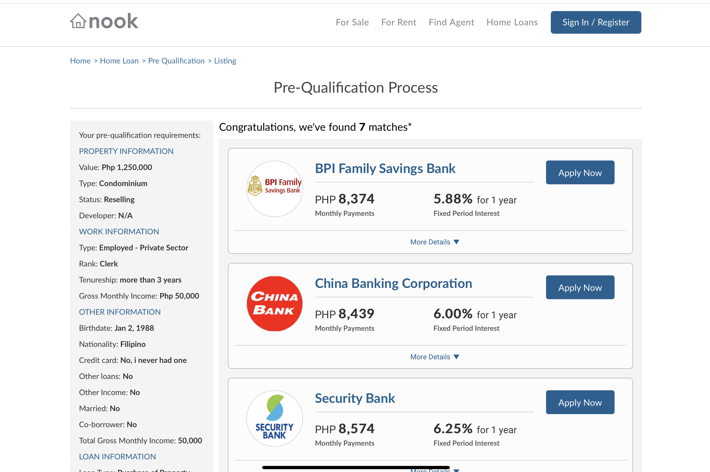

4) Compare bank offerings carefully

Banks provide different financing plans and options, which is why you should take a good look at what each one has to offer to know what works best for you. For instance, some banks have longer payment periods, while others do fixed interest rates. You should also consider the fees that various banks charge, and see how flexible their offerings are. Comparing carefully can save thousands or even millions of pesos over the life of the loan.

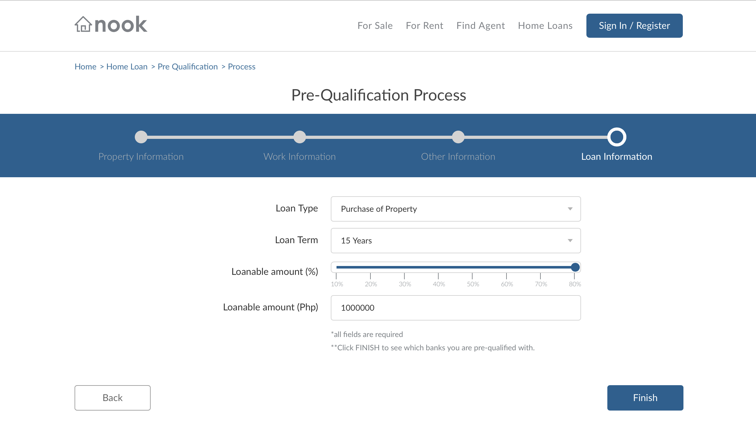

Get pre-qualified in minutes, not days! Given Nook’s partnership with top banks in the Philippines, they can easily guide you through your whole home loan process and endorse you to the right partners you need.

Once everything is set, Nook lets you browse through various options that are within your parameters!

You can have an easier home-buying process through the online platform, Nook, the first and only online mortgage broker in the Philippines. Designed to make applying for a home loan much simpler and easier, Nook has partnered with the eight of the top commercial banks in the Philippines to give home buyers a wide array of financing options that match their needs. The process can be overwhelming without some assistance but Nook helps borrowers through the whole loan process for free.

Nook lets you choose the home loan that suits your needs, and apply without any hassle. You can know the amount of monthly repayments you have to make, fees, and other banking requirements from each bank, and submit your requirements online – all for free.

Search smartly and save thousands for your dream home. With Nook, you can do just that! For more details and updates, visit Nook’s official website at www.nook.com.ph.