Did you guys know that only 53% of the adult population saves, according to the Bangko Sentral ng Pilipinas’ 2019 Financial Inclusion Survey? This outcome is as frightening as it sounds. As a result, the significance of saving money should be highlighted more frequently.

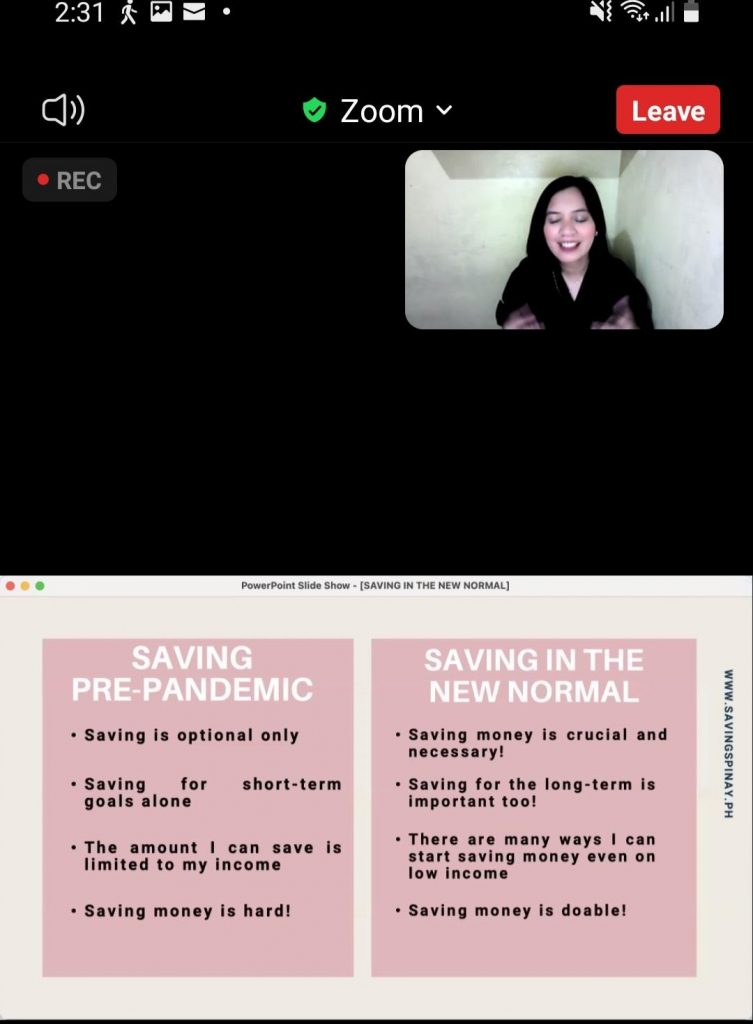

In our zoom meeting, luckily, I was invited, I am so delighted to learn and have insightful knowledge about saving. There it gives us ideas on how we can save and how important saving is. Things that I learned during the session is that we have a lot of things that need to prioritize and that we must also include savings as a priority. Also, I realized that I have to control my impulses to do my saving act well. Little by little we can make a change and have better security for ourselves. At my age right now saving money is also a form of investment because at the end of the day I can use this with all my future needs and endeavors.

World Savings Day is a day set aside for financial institutions, both governmental and commercial, as well as financial activists, to come together to promote saving mobilization. The concept is simple: saving is for all Juans!

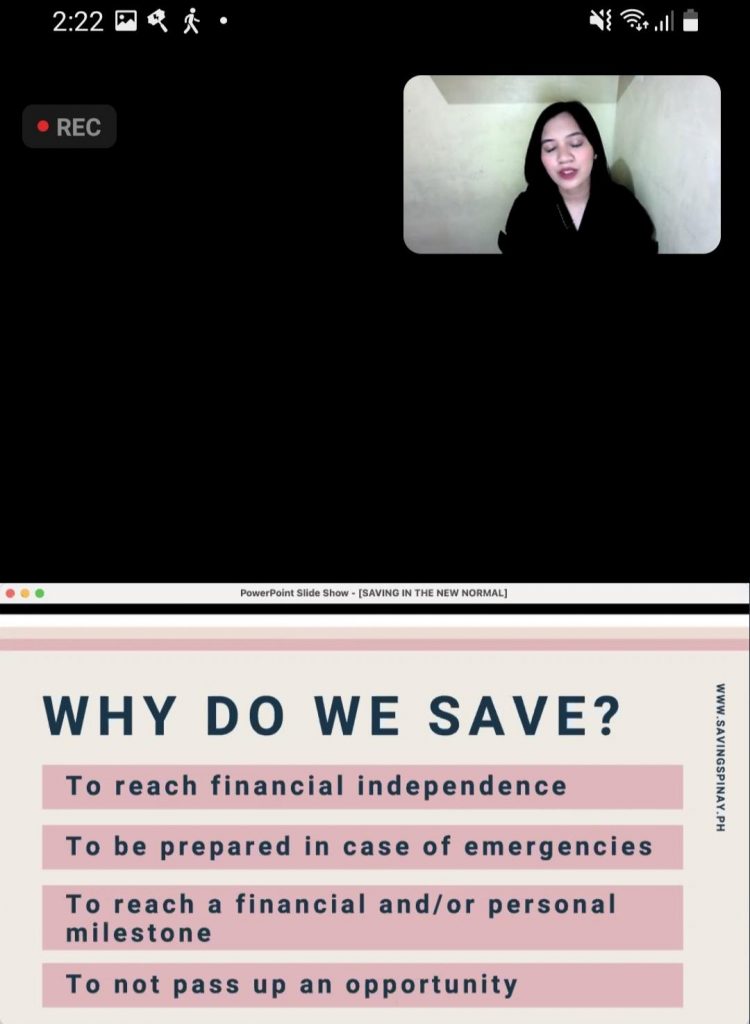

Here are some more reasons to learn how to save money:

To achieve financial freedom

The ultimate goal for people who are financially knowledgeable is to achieve total financial independence, where you will never have to worry about your finances again. This is only possible if you manage your finances well.

To be ready in the event of an emergency

Unexpected expenses, such as car repairs, job loss, or family medical issues, necessitate the establishment of an emergency fund. Your savings may be sufficient to meet the amount required for the unforeseen expenses, ensuring that you do not go into debt.

To achieve a financial and/or personal goal

Saving money allows you to fulfill all of your financial and personal objectives. You can never buy and invest in a house and lot or a start-up business without appropriate savings. You’ll need to save money in order to afford a larger down payment on a home. A new car or a trip overseas are examples of personal milestones.

Not to miss out on a chance

Life presents us with opportunities that may or may not be financially rewarding. A seat sale to your favorite location, a pre-sale house and lot within your budget, a new stock in the IPO stage, or even a new company idea are all examples of opportunities. Your money could be used as a start-up fund. Keep in mind that the more money you have, the more possibilities you’ll have.

Especially in all the crises that we’re facing there’s a lot more reasons why people must save. As we face difficulties and unforeseen circumstances, we can’t predict what will happen in the future. We might lose our jobs and or face a financial crisis or health related issues and as for that we can lean on the amount we kept from our savings.

One of the most essential financial lessons we’ve learned from the current pandemic crisis is the need to save money. Emergencies do occur, and those who have not budgeted for them will find themselves worried about how to make ends meet. The pandemic also provided people with newfound leisure to pursue their side hustles for extra cash. People are becoming bakers, internet sellers, and vloggers, and firms in the health supply industry, such as masks, are expanding. When you undertake a general home cleaning, this is also a good time to sell any unused stuff you have. Finally, for individuals who work in an office, the shift to online school implies further savings for lunch and transportation.

How much you can save is mostly determined by your salary. Perhaps you’re considering a savings target that’s higher than what you’re getting paid. If you want to save more money, you should raise your salary and look for alternative ways to supplement your income. The more money you earn, the more money you should save, not the other way around. Consider it a never-ending wealth loop.

Saving is much more convenient thanks to Cebuana Lhuillier. As they changed their 24k Micro Savings Card to a normal Savings Card with all the perks of an ATM, minus the exorbitant startup deposit and daily maintenance balance requirements, which may deter most wage-earners like me.

According to Ms Lorna Z Teczon, Cebuana Lhuillier Bank’s Head of Digital Banking and Strategic Alliances, “This is as easy as depositing a minimum of P50 to open an account or P1 to reactivate a dormant account, and you can, with a minimal or zero fees, send, receive, save money with interest and withdraw from nearby Cebuana Lhuillier branches and BancNet ATMs.”

Saving is introduced to regular people, freelancers, and youngsters by making banking accessible not only to wage earners, but also to those who don’t, can’t, or haven’t experienced opening a bank account due to prohibitive restrictions.

This convenience is enough to persuade people to start saving without worry of becoming caught in bureaucracy or being turned off by commercial banking jargon.

So, what are you waiting for to make a better future and secure a means for yourself by saving money. As we commemorate World Savings Day it gives us an idea on how it is really important to us.