- In 2025, 97% of local companies have set sustainability targets. However, only 51% have implemented comprehensive strategies, leaving a 46% gap between ambition and execution.

- 92% of companies in the Philippines this year are already applying or interested to apply AI to advance their sustainability ambitions, demonstrating its potential as a sustainability accelerant.

- For the private sector, sustainability investments remain constrained, with economic uncertainty still the top concern but easing from 49% in 2024 to 45% in 2025.

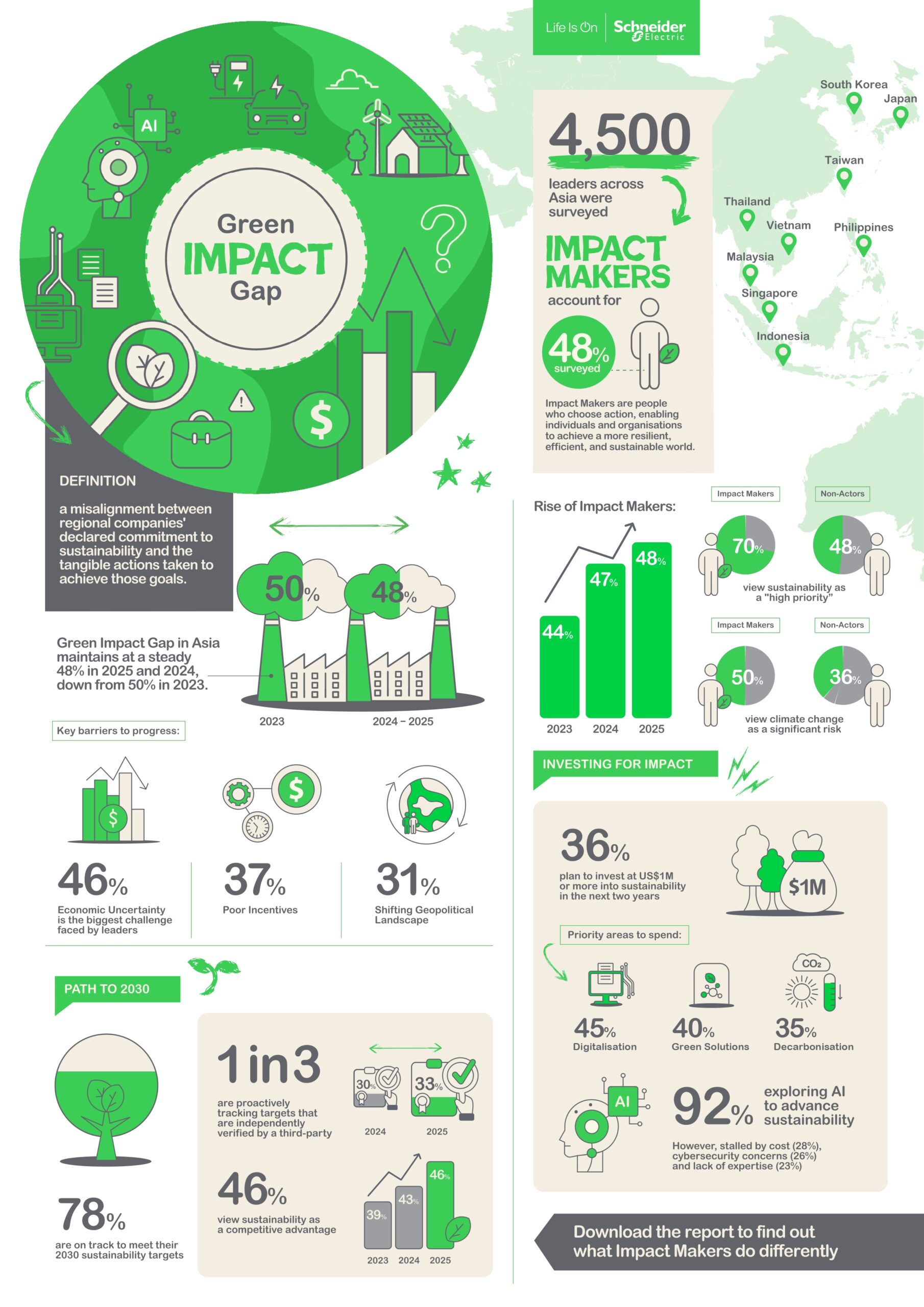

Global energy technology leader Schneider Electric today released the findings of its annual Green Impact Gap survey, which showed that Philippine business executives increasingly see sustainability as a driver of growth and competitiveness, despite citing geopolitical unrest and economic uncertainty as obstacles to additional sustainability investment.

97% of businesses have set sustainability goals. According to 58% of them, technological improvements have made sustainability reporting easier in the past year. However, 32% still have difficulties, citing things like growing expenses.

This year, 55% of company leaders identify innovation and competitiveness as key drivers of sustainability, with the strongest emphasis from the semiconductors (71%) and data centers (60%) sectors, followed by real estate (53%) and healthcare (52%). This underscores how industries increasingly link sustainability with business innovation.

Sustainability is also delivering tangible business value. This year, 52% of leaders say it creates new business opportunities, up from 42% in 2024. Similarly, 42% pursue sustainability to strengthen brand and reputation, compared with 32% last year, while 46% cite cost savings and financial benefits, up from 43%. These year-on-year gains demonstrate that sustainability has evolved from a peripheral initiative into a core strategy for competitiveness and resilience.

Misalignment between declared goals and tangible action persists

While findings underscore the growing commitment to sustainability in the Philippines, they also reveal a persistent ‘Green Impact Gap’ — the misalignment between companies’ declared sustainability goals and the tangible actions taken to achieve them. This year, 97% of companies set targets, but less than half are taking comprehensive action, keeping the regional Green Impact Gap at 46%.

With 2025 marking a critical milestone on the path to 2030 climate goals, companies remain optimistic. Around 84% express confidence in meeting or exceeding their 2030 targets, while 20% report being more than three years ahead of schedule.

“Companies across the Philippines are not just weathering the storm—they’re using sustainability as a compass to navigate it,” said Ireen Catane, Country President, Schneider Electric Philippines. “Despite volatile economic conditions, early movers and adopters are turning to digitalization and AI to drive efficiency, mitigate risk, and create lasting value.”

In parallel, two-thirds of companies (66%) report being very or moderately familiar with Republic Act 11285, the Philippines’ Energy Efficiency and Conservation Act. Among these, 85% express moderate to high confidence in meeting its requirements, signaling readiness to implement concrete energy-efficiency measures. This trend aligns with the DOE’s national efforts to promote energy efficiency, supporting businesses and local governments in optimizing energy use while advancing sustainability goals.

AI unlocks cost savings and energy efficiency

Artificial Intelligence (AI) is helping companies address financial and energy risks. 92% of companies in the Philippines this year are already applying or interested to apply AI to advance their sustainability ambitions. At 59%, AI for energy consumption optimization now tops the list of energy and resource efficiency applications, rising ahead of waste management (50%) and smart building management and automation (49%).

Companies see AI’s biggest impact on sustainability in automating data collection and reporting (51%), optimizing energy use (44%), and enhancing product design (44%). By improving energy efficiency, AI helps mitigate cost risks, aligning with the 46% of company leaders who cite financial benefits and savings as key drivers for sustainability amid persistent energy price concerns.

With the rise of energy demand in the Philippines, which the Department of Energy (DOE) projects will grow 4–5% annually and potentially double total power consumption by 2040 under the Philippine Energy Plan, companies continued to adjust their decarbonization strategies in 2025. The most widely adopted measures were switching to low-carbon or electric vehicles for transport (27%, up from 25%), and investing in research and development to drive innovation in low carbon technologies (27%, up from 25%).

From 2024 to 2025, companies advanced in cutting Scope 2 emissions—indirect emissions from purchased energy such as electricity, steam, heating, and cooling—through onsite renewables (34%, up from 29%) and energy-efficient equipment (41%, unchanged). They also adopted emerging measures like Green IT plans (31%). Efforts to reduce Scope 3, or value chain, emissions also grew, with gains in supply chain optimization (33%, up from 29%) and in promoting remote work and video conferencing to cut commuting and travel-related emissions (31%, up from 30%).

Investments hold steady despite economic uncertainty

With business leaders seeing the bottom-line benefit of sustainability, planned investment in sustainability transformation has held steady with 23% of companies planning to invest at least $US1 million over the next two years.

While major barriers to investment in sustainability still exist, most have somewhat decreased annually. Although it decreased from 49% in 2024 to 45% in 2025, economic uncertainty is still the biggest worry. Internal budgetary restrictions declined more sharply, from 48% to 37%, while weak incentives (36% to 35%) and regulatory and policy challenges (37% to 35%) also slightly declined. These changes imply that, despite ongoing structural and financial difficulties, the investment environment in 2025 is comparatively better for corporate sustainability than it was in 2024.

In its third year, 4,500 middle- to senior-level executives from nine Asian markets—Indonesia, Japan, South Korea, Malaysia, the Philippines, Singapore, Taiwan, Thailand, and Vietnam—participated in the Schneider Electric Green Impact Gap survey, which was carried out in collaboration with Milieu Insight. The survey consists of 30 questions that gather information about how companies are prioritizing and investing in sustainability.